Annual depreciation tax shield calculator

Depreciation Tax Shield 20000. To see how this formula is used lets.

Tax Shield Calculator Efinancemanagement

Depreciation Tax Shield 100000 20.

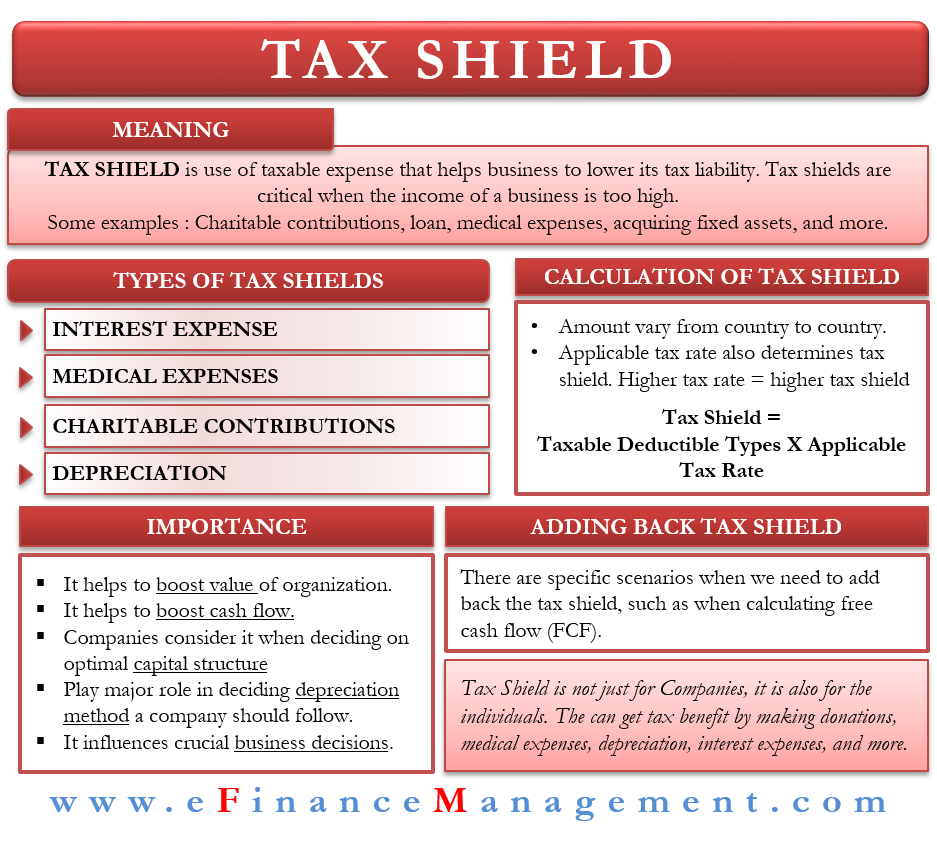

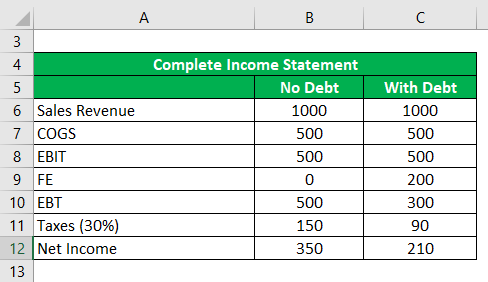

. This calculator includes the following algorithms. Depreciation Tax Shield Depreciation Expense Tax Rate If feasible annual depreciation expense can be manually calculated by subtracting the salvage. Tax Shield Deduction x Tax Rate.

Lets imagine that the entire Business is worth 1000. 75000 The correct answer is a. Annual Depreciation Tax Shield Equation.

Depreciation tax shield calculator. Depreciation Tax Shield Formula. Finally the tax shield is calculated by multiplying the sum of tax-deductible expenses and the applicable tax rate as shown above.

How is depreciation tax shield calculated in Excel. After-tax benefit or cash inflow calculator. Tax Shield Calculator This small business tool is used to find the tax rate by using interest expenses and depreciation expenses.

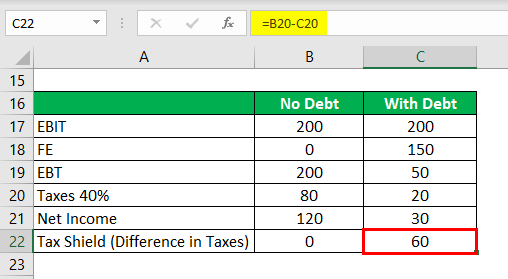

Operating Profit is calculated as. Depreciation amount asset value multiplied by the annual percentage. Depreciation Tax Shield Depreciation Expense X Tax Rate As you can see with this formula you can calculate how much you can shield yourself from taxes by leveraging.

Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. Mathematically it is represented as Tax Shield Formula Sum of Tax-Deductible Expenses Tax rate. Depreciation Tax Shield Formula.

Depreciation or CCA tax shield depreciation or CCA amount x. Enter the applicable tax rate and the total depreciation that can be deducted into the calculator to determine the depreciation tax shield. The calculation of depreciation tax shield can be obtained by depreciation expense and tax rate as shown below.

Assuming depreciation totaled 20000 and a tax rate of. 75000 The correct answer is a. This is usually the deduction multiplied by the tax rate.

What is the amount of the. Balance is the asset value minus the depreciation value. The effect of a tax shield can be determined using a formula.

Depreciation or CCA tax shield depreciation or CCA amount x marginal tax rate 75000 x 35 26250 7. Tax Rate Tax Deductible Expenses1 Add Expenses. Depreciation is a deductible expense and a portion of the depreciated amount can therefore lessen the owners overall tax burden.

What is the amount of the annual depreciation tax shield for a firm. Cost Of DebtCost of debt is the. In short the Net Present Value of the Depreciation Tax Shield is 5 lower with the Sum-of-Years-Digits approach.

Depreciation tax shield formula examples how to calculate step by calculation with example definition does it works template. Depreciation Tax Shield Sum of. Depreciation Tax Shield Depreciation Applicable Tax Rate.

How To Npv Tax Shield Salvage Value Youtube

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Meaning Importance Calculation And More

Tax Shield Formula Step By Step Calculation With Examples

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula And Calculator Excel Template

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

Operating Cash Flow Overview Formula What Is Operating Cash Flow Video Lesson Transcript Study Com

Tax Shield Formula How To Calculate Tax Shield With Example